The Empty House Next Door

Renowned city planner and housing advocate Alan Mallach presents effective strategies for community leaders, local officials, and nonprofits contending with vacant properties in the United States.

In Cleveland, it is easy to see the result of capital flight. As businesses and industries left for the suburbs, abandoned storefronts and factories proliferated. Efforts to reverse Cleveland’s decline have focused on investment downtown, but for the city to truly regain its health, it must further expand its property tax base by reviving its neighborhoods.

The land we occupy and live on in Hough is just as valuable to us as their land in Hunting Valley is to them.

In a once-thriving part of Cleveland, abandoned and decaying buildings suppress the value of land and hamper local efforts to revitalize. By joining forces with city planners, nonprofits, and a land bank, residents are working to take control of these blighted properties and turn around their neighborhood.

Speculators take advantage of a housing downturn by buying property at rock-bottom prices then waiting to sell until prices rise. This process can take years, leaving the properties vacant and deteriorated. One promising solution? The land bank.

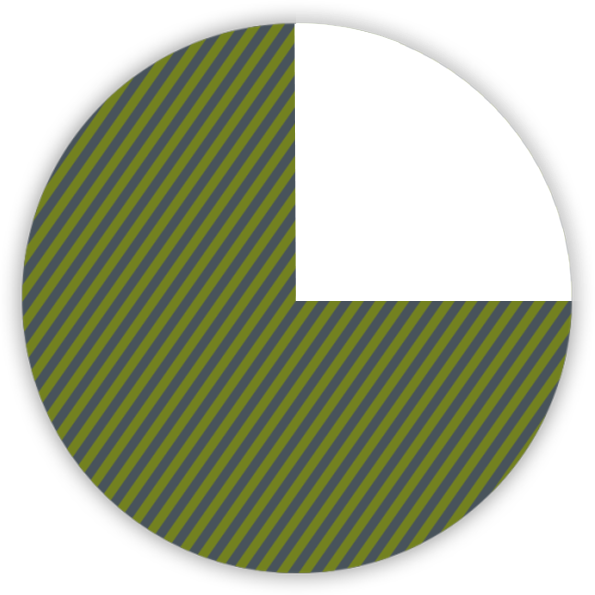

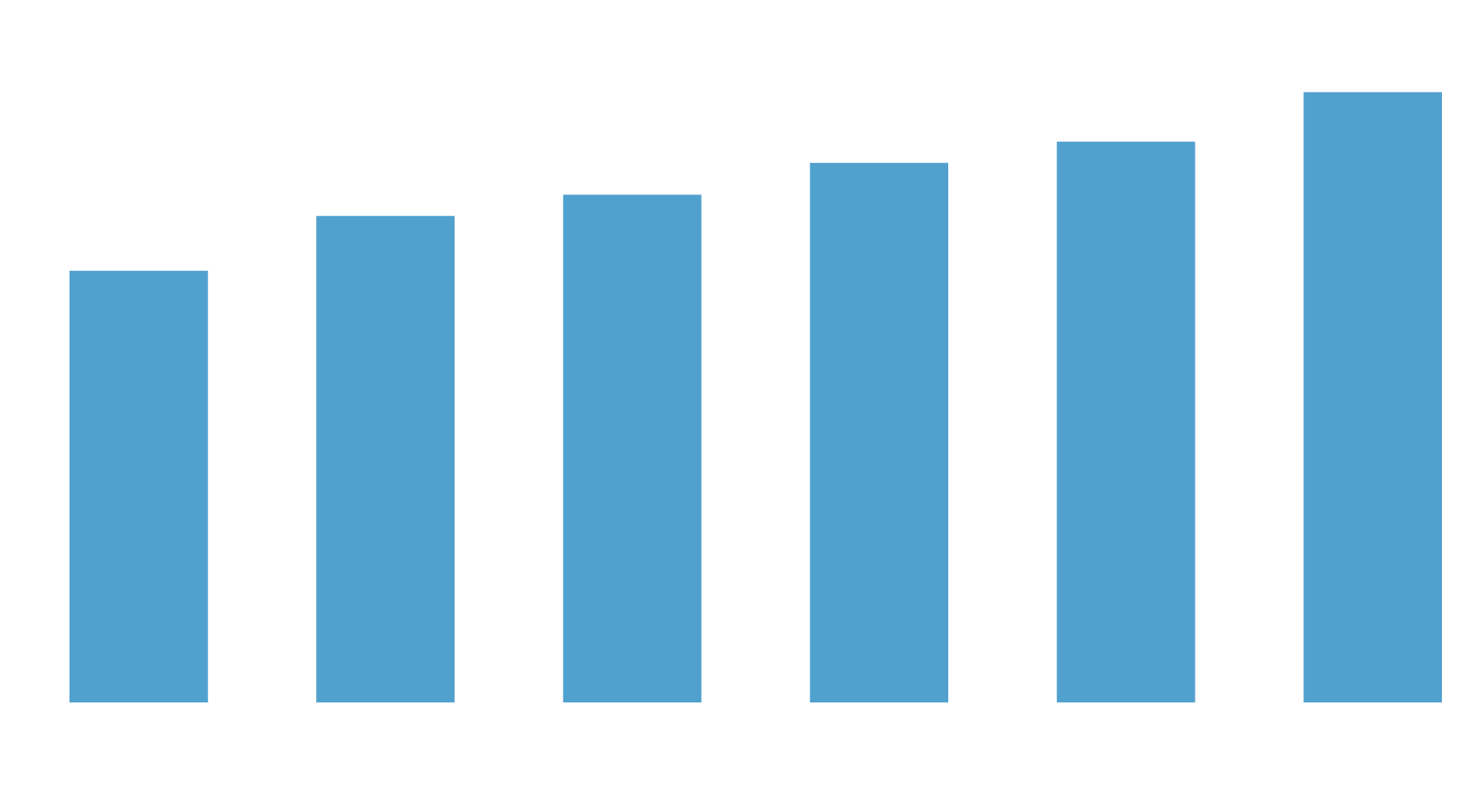

Vacant and Abandoned Properties Eliminated in Cleveland since 2006

Side Yards Created

Affordable Single Family Homes Created

Affordable Units in Multifamily Buildings

We could leave that lot vacant for the next 40 years, and it could keep paying $14,000 a year in property tax. When it’s over, we’re going to see $800,000 a year in property tax.

Like many cities, Phoenix provides property tax breaks to some property owners to encourage development. The city believes these incentives are necessary to create a more vibrant downtown, but they result in higher tax rates for those who do not receive preferential treatment.

Renowned city planner and housing advocate Alan Mallach presents effective strategies for community leaders, local officials, and nonprofits contending with vacant properties in the United States.

State and local governments use many types of property tax incentives to increase business development.

Tax increment financing is a wildly popular economic development tool in the United States, but it often falls short of its promise to revitalize struggling neighborhoods.

An informed citizenry is an empowered one, but educating taxpayers and voters can be difficult.

We all know the best thing for the city is greater access to the water; everyone around the United States is trying to do that, but not everyone has the buy-in.

Tracking the growth of “downtowns” in both a city and a suburb, data reveals a sign of their continued popularity: a disproportional uptick in residential units.

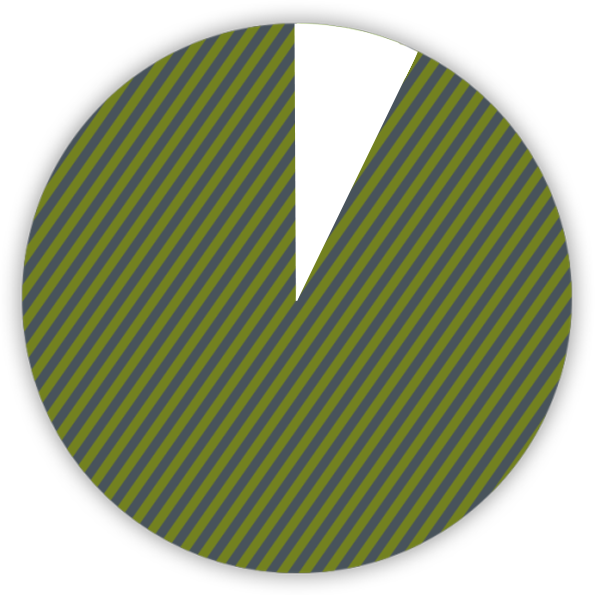

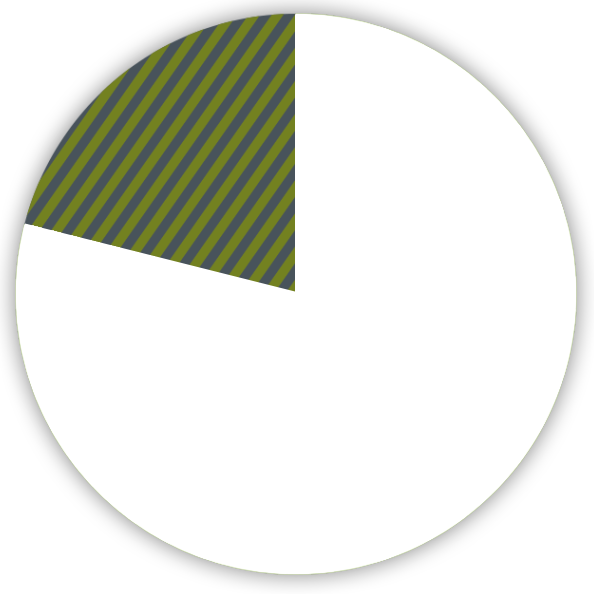

Downtown Housing Occupancy in 2018

Downtown Residents Works in Healthcare

This report explores the challenges of regenerating America's legacy cities and suggests ways to overcome obstacles such as job and population loss.

This report identifies replicable strategies that have helped smaller legacy cities overcome population loss, neighborhood disinvestment, unemployment, and other problems.

Like many coastal cities, Miami is facing a climate future that is already here.

Tax increment financing is one of the most widely used – and least understood – public finance mechanisms in the U.S. today. David Merriman talks about what communities can do to avoid the pitfalls.

What they imagine is Gotham or Hong Kong springing up around their beautiful family home. What we’re talking about is a little bit different.

With the arrival of 2020, Minneapolis becomes the first major U.S. city to implement a ban on single-family zoning in every neighborhood.

Recent news stories routinely feature “hot market” U.S. cities with astronomical housing prices that end up displacing residents with moderate or low incomes.

In an era of tight budgets and exploding need, cities around the world are funding infrastructure and other public improvements through land value return, also known as land value capture.

An informed citizenry is an empowered one, but educating taxpayers and voters can be difficult.

Imagery in the above videos are courtesy of the following:

Creating Housing: Oregon State Government; The Oregonian/Barcroft Media; The Oregonian Op-Ed; Pond5; Portland Bureau of Planning and Sustainability; Portland Community Reinvestment Initiatives; Shane Burley; Willamette Week.

Dream Neighborhood: Cleveland Metro School District; Pond5; Shane Wynn; Shutterstock; Threeblur0; Western Reserve Historical Society.

Green City: FreshWater.

Lakefront City: Google Maps; The National Archives; Smithgroup JJR.

Taxes and Towers: Arizona State University; Dibble Engineering; Pond5; Tom Carlson/Phoenix New Times.

The Water Game: Arizona Capitol TV; Arizona Governors Office; AZ Central/Imagn; Brigham Young University Museum of Art; Central Arizona Project; Pima County Arizona; Pond5; Pueblo Grande Museum, City of Phoenix, Artist’s rendition of the Hohokam canals by Michael Hampshire; Shutterstock.

Click here to watch the original Making Sense of Place series in its entirety.